iMotorsports, one of the largest pre-owned motorcycle dealers in the country purchased St. Pete Powersports in St. Petersburg, Florida from…

iMotorsports, one of the largest pre-owned motorcycle dealers in the country purchased St. Pete Powersports in St. Petersburg, Florida from…

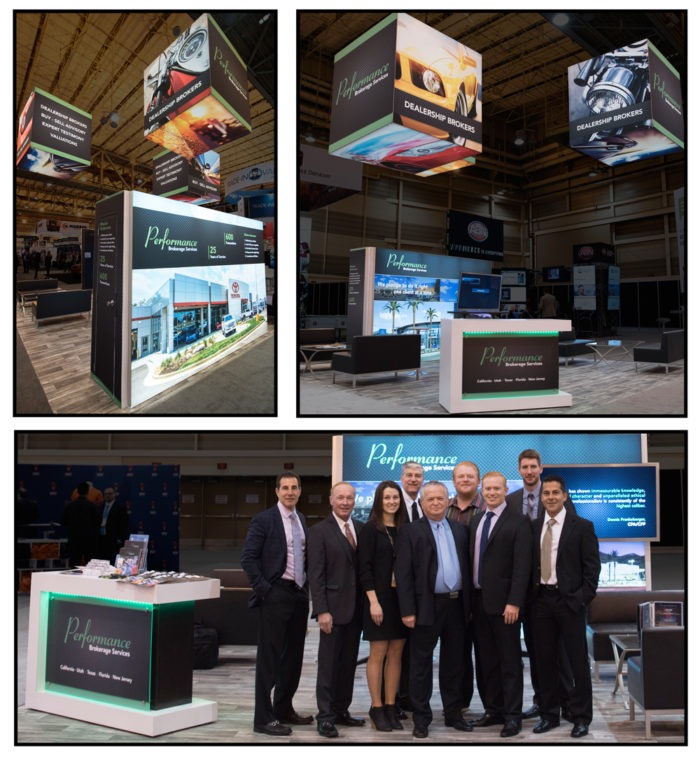

Thank you for visiting Performance Brokerage Services, Inc. at NADA in New Orleans. If we missed you, please call to…

Performance Brokerage Services, Inc. is pleased to announce the purchase and sale of Jenkins Nissan of Brunswick, Georgia from Donald…

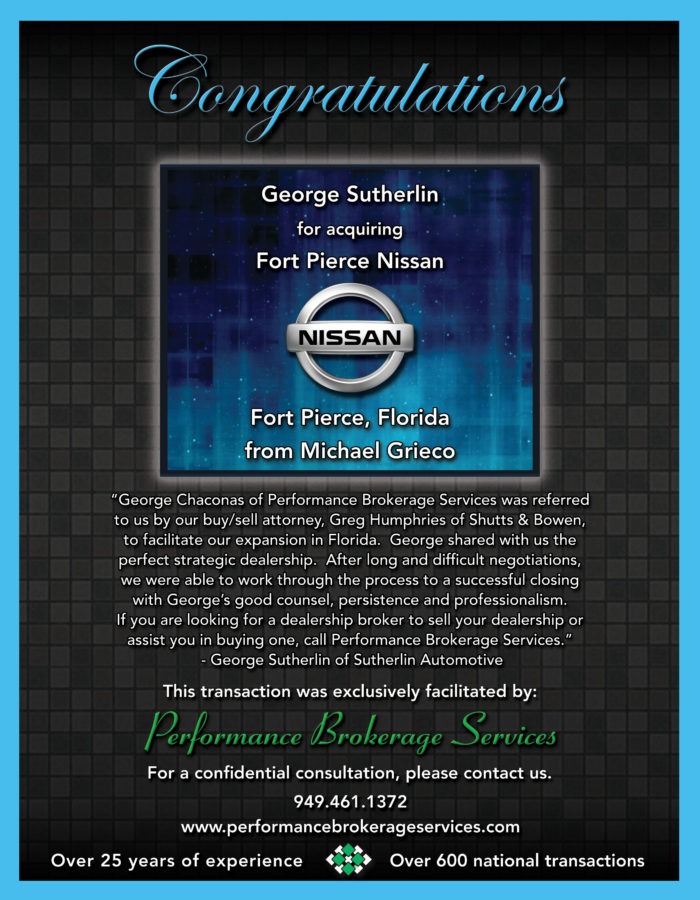

Performance Brokerage Services, Inc. announces the sale and purchase of Nissan of Fort Pierce, Florida from Michael Grieco to George…

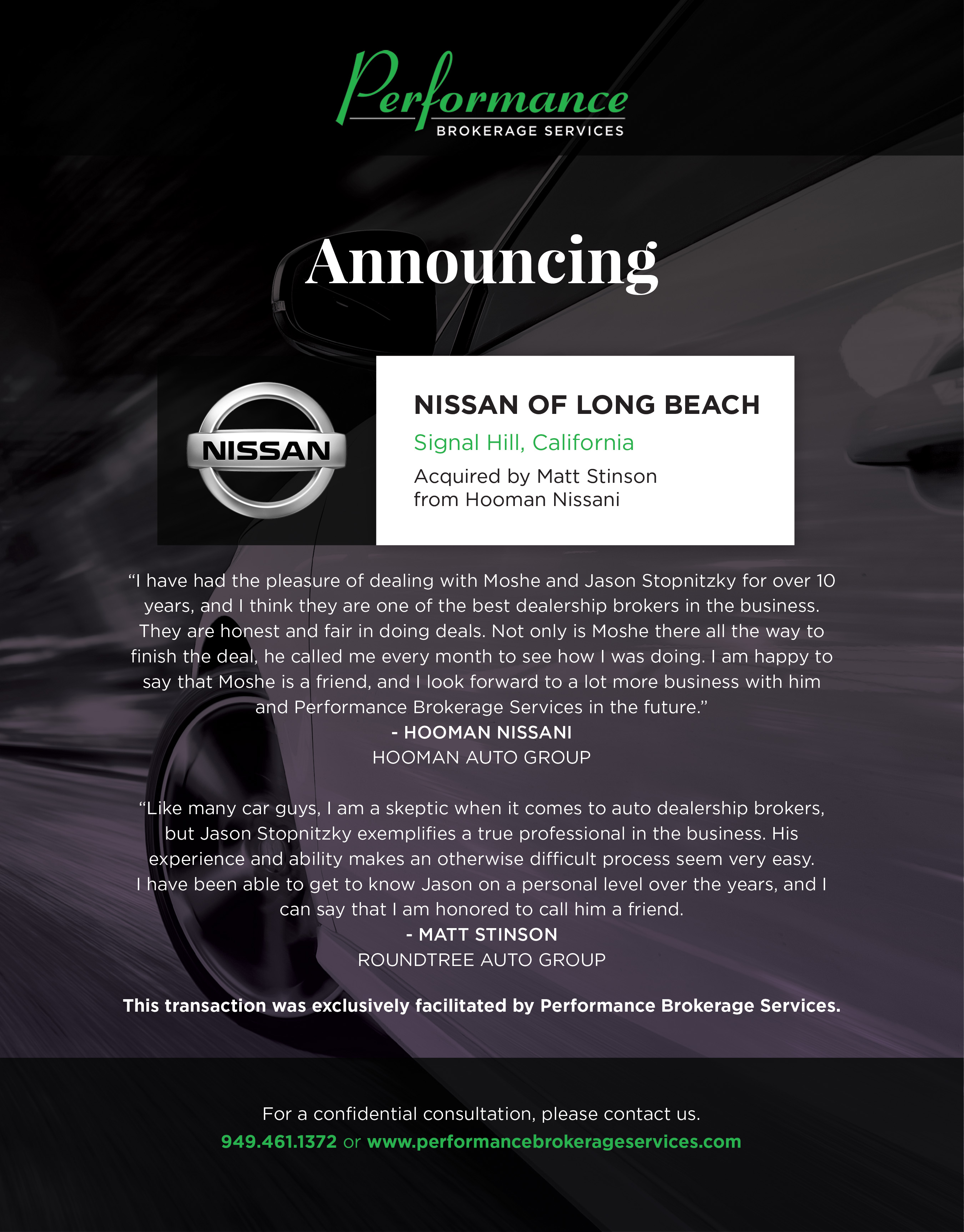

Performance Brokerage Services, Inc. announces the sale and purchase of Nissan of Long Beach by Matt Stinson and Roundtreee Automotive…

Performance Brokerage Services, Inc. announces the purchase and sale of 2 Toyota dealerships in Fredericksburg and Stafford, Virginia from Ron…

Ozzie Giglio, owner of numerous Harley-Davidson dealerships in Illinois, has now acquired his first dealership in Wisconsin, the iconic Milwaukee…